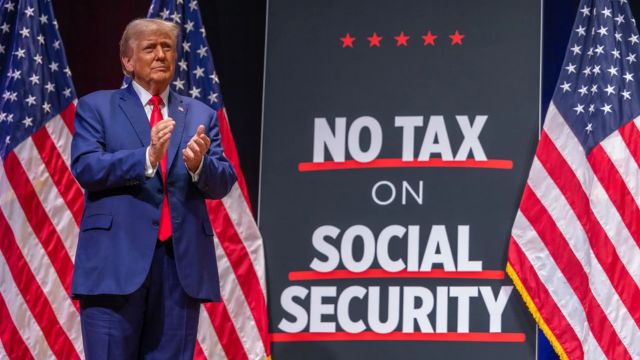

With the inauguration of a new Trump presidency, sweeping changes to government programs, including Social Security, could be on the horizon. President-elect Donald Trump has prioritized cutting government spending, introducing the Department of Government Efficiency to identify and reduce expenditures to achieve a net surplus.

While this focus on fiscal restraint may sound promising to some, the potential consequences for Social Security beneficiaries are cause for concern. Experts warn that proposed reforms, including eliminating federal income taxes—part of which fund Social Security—may jeopardize the program’s long-term stability.

The Challenge of Funding Social Security

Jasmin Smoots, vice president of operations at PensionBee, expressed skepticism about the feasibility of Trump’s proposals. “Trump has most recently floated an explosive reform to eliminate federal income taxes, some of which fund Social Security,” she told GoBankingRates. “Replacing this income source would be difficult, as the Trump administration is generally in favor of cutting and slashing taxes across the board.”

While tariff funding has been suggested as a replacement, Smoots emphasized that the scale required to offset the loss of federal income tax is impractical. “Replacing federal income tax in its entirety would require tariffs as high as 75%, substantially above the incoming administration’s latest proposals of 25 to 35%. Without a credible replacement for any tax cuts, Social Security could easily become the victim of campaign promises,” she added.

For beneficiaries, this uncertainty underscores the importance of proactive financial planning to mitigate the potential impact of cuts or reforms.

Strategies to Protect Your Financial Future

If Social Security faces significant changes, beneficiaries will need to rely on smart planning and diversified income sources. Experts recommend the following steps:

1. Build Up Your IRA

Individual retirement accounts (IRAs) are independent of Social Security and can serve as a vital supplement to insufficient benefits. Increasing contributions to an IRA can significantly boost retirement income.

“Diversifying your income sources and supplementing Social Security income through an individual retirement account can significantly enhance your financial security and peace of mind,” Smoots said. However, she noted that less than a third of households currently have a traditional IRA, leaving many unprepared.

2. Contribute to Your HSA

Rising healthcare costs are a common challenge for retirees. A health savings account (HSA) can help offset these expenses and provide greater financial security.

“Retirees should prepare for rising healthcare costs by exploring supplemental insurance options, health savings accounts (HSAs), and long-term care insurance,” Smoots advised. These tools can help bridge gaps in coverage and ease the financial burden of medical care.

3. Take Advantage of Lower Taxes

Trump’s tax policies are expected to continue offering lower rates, presenting an opportunity for strategic financial moves. Chuck Czajka, a certified Social Security claiming strategist and founder of Macro Money Concepts, highlighted the importance of capitalizing on this “window of tremendous opportunity.”

“With taxes likely to remain on sale for a few more years, there’s a tremendous opportunity to convert taxable retirement plans to a tax-free platform,” Czajka said. He also emphasized the benefits of exploring tax-free Social Security options to fund retirement needs.

4. Preserve Your Wealth

While building wealth is important, maintaining financial stability in retirement is critical. Czajka advised retirees to focus on securing their required income and avoiding unnecessary risks.

“Another best practice is ‘owning your number.’ That’s right. Owning the number you require is way more important than risking your numbers,” Czajka said. “Losses can hurt more than gains can help once retired.”

Looking Ahead

The potential changes to Social Security under the Trump administration serve as a reminder of the fragility of government-funded programs and the importance of personal financial preparedness. While it remains to be seen how these reforms will unfold, beneficiaries can take steps now to safeguard their retirement and reduce reliance on uncertain federal benefits.

By diversifying income sources, planning for rising costs, and taking advantage of current tax policies, individuals can better weather the potential challenges ahead.