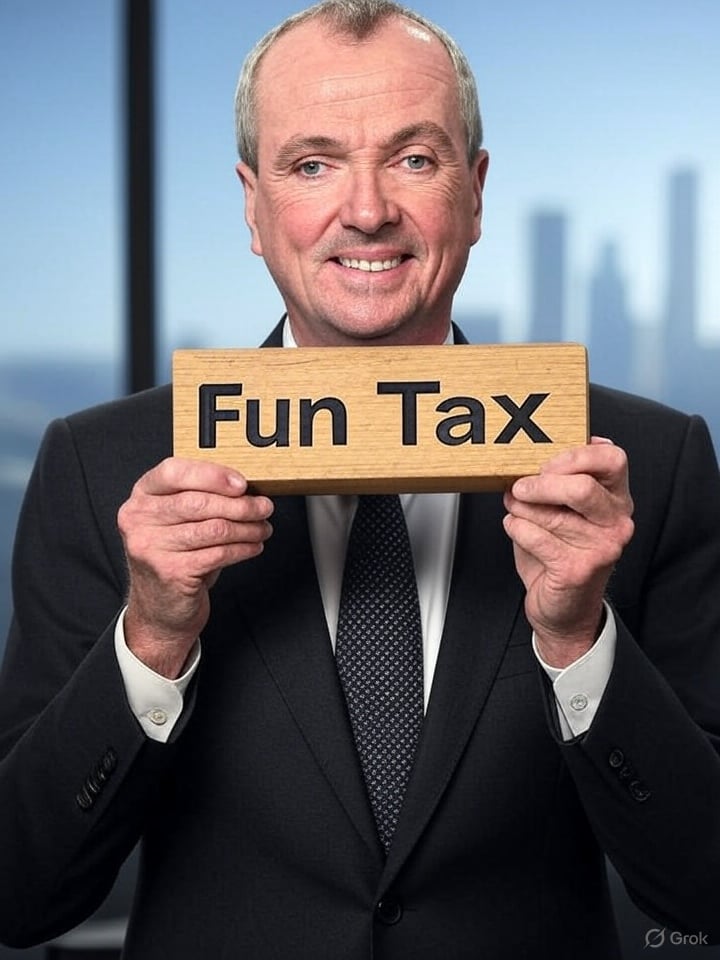

If taxing fun is your main concern, then New Jersey isn’t the state for you.

TRENTON, N.J.

— Governor Phil Murphy is facing renewed opposition from Republican lawmakers over a proposal in his latest state budget that would impose sales taxes on a variety of recreational and participatory sports activities currently exempt under New Jersey law.

The proposal, part of the administration’s broader Participatory Sports initiative, would eliminate the existing sales tax exemption for patrons engaged in certain leisure activities, potentially raising costs for families across the state. The change would apply to activities such as bowling, mini golf, laser tag, skating, and more.

“Democrats are trying to tax fun and destroy what little enjoyment people have left,” said Senator Declan O’Scanlon (R-13), a vocal critic of the plan. He labeled the measure a “cash grab” and blamed what he called the Murphy administration’s “spending addiction.”

Under the proposed changes, patrons would begin paying sales tax on 13 popular activities, including go-kart rides, tennis court fees, golf driving ranges, swimming pool access, and paintball. These activities are currently exempt under state law.

Murphy’s office has not released detailed justifications for the inclusion of the tax changes, and Democratic lawmakers have yet to issue a formal response to the criticism. The governor’s full budget proposal is still under legislative review.

Recreational businesses could be impacted

If enacted, the measure could also affect small businesses that operate in the recreational sector, which may have to adjust pricing or operations to accommodate the new tax structure. It remains unclear when the proposed taxes would take effect or how much revenue they are projected to generate.

Republicans say the proposal unfairly targets everyday leisure enjoyed by working families and could discourage participation in youth sports and community activities.