The affordability of homebuying in California would need to be drastically changed.

Using housing indices from mortgage-tech company ICE and salary statistics from the US Bureau of Economic Analysis, my go-to spreadsheet correlated home price rises with income growth for ten major California urban regions.

Let’s start by looking at these California metro areas’ predicted median house payment.

Assuming a 20% down payment, the average monthly payment for a $509,400 home purchase in 2018 was $2,020 at an average mortgage rate of 4.3%.

With two earnings, that amounted to 22% of the average house hunter’s $109,100 salary.

Next, consider the payment on a median-priced property of $759,500 today. With 6.9% interest rates, the monthly payment increased to $4,000.

Now, 32% of the $148,500 income—which has increased 36% over the past six years—is consumed by the mortgage.

What would be necessary, then, to restore this financial burden to its pre-coronavirus state?

Rates would need to drop to 3.5 percent. Earnings would have to increase by 50%.Or a 33% decrease in prices would be required. perhaps a mix of the three.

A third fewer California houses will be sold this year than in 2018 due to this lack of affordability.

How did we get here?

Recall that during the pandemic, a number of factors, including the need for additional living space, mortgage rates below 3%, and stimulus payments that increased salaries, upended the housing market.

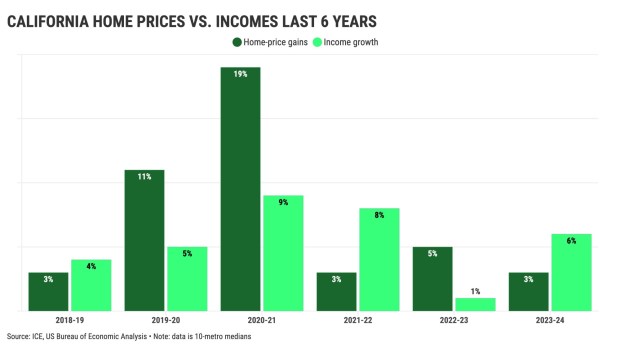

Let’s now examine how rising per capita incomes during the six years ending in 2023 compare to six years of property appreciation through October.

Home price increases exceeded earnings in eight of these ten California metro areas. This is their ranking based on the gap.

In Bakersfield, property values increased by 63% while incomes increased by 29%.

Inland Empire: 37% income increase compared to 65% home gain.

San Diego: 39% income growth compared to 66% home gain.

Fresno: 33% income increase compared to 60% home gain.

Ventura County: 36% income growth compared to 51% home gain.

LA-OC: 39% income growth compared to 50% home gain.

Sacramento: 35% income increase compared to 46% home gain.

Stockton: 45% income growth compared to 50% home gain.

Additionally, salaries outpace property prices in two California metro areas.

San Jose: 54% income increase followed by 34% home gains.

San Francisco: 46% income increase followed by 26% home gains.

Sliver of hope

The good news for homebuyers is that appreciation is slowing down.

In all but one of the 10 metros, price increases for the 12 months ended in October were far less than the prior five-year appreciation trend.

The largest decline was in San Diego, where prices increased 3.2% over the previous year, compared to an average yearly gain of 9.9% from 2018 to 2023. The cooldown is 6.7 percentage points.

The only location where appreciation did not decline was San Jose. Its 5.1% year-over-year gain was marginally higher than the 5% annual rises of 2018–23.

Here is a ranking of the nine other metros based on appreciate chill and ICE calculations.

Inland Empire: 6.3 points lower, a 3.5% year-over-year gain compared to an average of 9.8% annual improvements in 2018–23.

Sacramento: 5.8 points cooler, a 1.7% year-over-year gain compared to a 7.5% annual gain in 2018–23.

Bakersfield: 5.3 points lower year-over-year rise compared to 9.4% yearly gain in 2018–23.

Stockton: 5.9% lower year-over-year gain compared to a 7.9% yearly gain in 2018–23.

Ventura County: 3.3% year-over-year rise compared to a 7.9% annual gain in 2018–23, 4.7 points lower.

Fresno: 4.7 points lower year-over-year rise compared to an annual gain of 8.9% in 2018–23.

Los Angeles-Orange County: 3.7 points lower year-over-year rise compared to a 7.7% yearly gain in 2018–23.

San Francisco: 3.1 points colder, 1.3% year-over-year growth compared to 4.4% annual gain in 2018–23.

Smaller increases in home values, nevertheless, are by no means a remedy because affordability actually entails price reductions.

The Southern California News Group’s business columnist is Jonathan Lansner. His email address is [email protected].

Note: Every piece of content is rigorously reviewed by our team of experienced writers and editors to ensure its accuracy. Our writers use credible sources and adhere to strict fact-checking protocols to verify all claims and data before publication. If an error is identified, we promptly correct it and strive for transparency in all updates, feel free to reach out to us via email. We appreciate your trust and support!