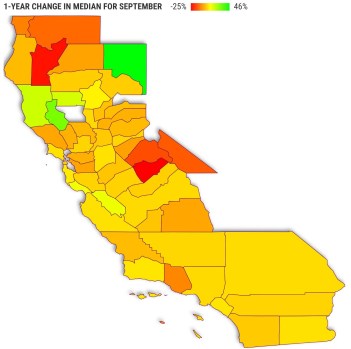

Home insurance non-renewals by county

Note: To view more, scroll the map. Jovi Dai Bay Area News Group’s map

Carolina Villaseca’s Brentwood neighborhood, with its rows of neat two-story, stucco-clad, tile-roofed homes and well-trimmed shrubs, hardly looks like a tinderbox a spark away from exploding in flames and joining the list of California communities scorched by wildfires that has alarmed insurers throughout the state, resulting in steep rate increases and lost coverage.

The annual price to renew Villaseca’s coverage, which had already increased significantly, would more than double from $2,700 to $5,770, according to a notice received by her insurer, Safeco Insurance, in October.

Villaseca, who has lived in the house with her husband for nine years, said there were no claims and the insurance company had no explanation at all. The price has increased annually, and in the last three years, it has increased tremendously, in my opinion. They make it impossible for many to afford insurance renewals.

Even though the cost was startling, Villaseca was able to find coverage when Mercury, another insurance, offered a policy for $3,100. According to a Bay Area News Group review of California Department of Insurance data, from 2015 to 2024, her Contra Costa County ZIP code, 94513, had around one out of ten house insurance policy non-renewals, the highest rate in the nine-county Bay Area.

In California, there have been almost 7.6 million non-renewals. According to the data, the state’s hardest-hit ZIP code was 92592 in the Riverside County city of Temecula, with 26,918 non-renewals over that time. The Brentwood ZIP code, with 19,366 non-renewals during that time, came in at number 16. Seven of the 15 California ZIP codes with higher non-renewals than Brentwood were located in Riverside County, which is located east of Los Angeles.

South San Francisco (94536) in San Mateo County, Gilroy (95020) and San Jose (95123) in Santa Clara County, Dublin (94568) and Fremont (94536) in Alameda County, and Santa Cruz (95060) in Santa Cruz County are the ZIP codes with the highest non-renewals in the region, according to the data. However, a number of additional ZIP codes with the highest Bay Area non-renewals were located in Contra Costa County, such as Antioch (94509) and Bay Point (94565).

Igor Dubrovsky, a co-owner of ESI Insurance Brokers, a San Francisco-based company that has been providing services to roughly 5,000 clients in the Bay Area for the past 15 years, was not surprised by that.

Every day, our organization received perhaps 300% more phone calls, and nearly all of the stories were the same, according to Dubrovsky. People come to me to tell me that they are looking for insurance since their provider has dumped them.

With estimated losses of over $35.8 billion, a string of destructive and expensive wildfires over the past ten years have left California’s property insurance industry in ruins. According to insurers, they are forced to limit their liability exposure or exit the California market entirely since they are unable to raise their rates to reflect growing costs and risk due to antiquated voter-approved regulations that were implemented in the late 1980s to ensure more equitable pricing.

Encouraged by Governor Gavin Newsom, Ricardo Lara, the state’s elected insurance commissioner, last fall proposed a plan to adopt new regulations by the end of this year that would address the main demands of insurers: the ability to pass on to consumers their own costs for reinsurance against catastrophic losses; rates based on risk modeling rather than historic losses; and faster rate hike approvals. Lara promised that insurers will be required to provide additional coverage in parts of the state that are at risk of fire.

According to Michael Soller, a spokesperson for the insurance department, those efforts are almost over, and relief is on the way as insurers like Farmers and Allstate have announced plans to increase coverage in the state as reforms are put into place.

“By the end of this month, all of the changes that Commissioner Lara announced late last year will be finalized and put into effect,” Soller stated. Our 30-year-old regulations are causing insurance firms to raise rates without issuing more coverage, despite the fact that the risk of wildfires has grown. We are revising regulations to require insurance companies to write more policies. And it will occur for the first time in California’s history.

However, consumer activists have questioned whether the new regulations will result in anything other than increased premiums, and insurers have warned that it may take years for changes to be reflected in coverage.

According to Jamie Court, president of Consumer Watchdog, Lara’s policies will result in significantly higher insurance costs for all homeowners.

There aren’t many options for homeowners in high-risk neighborhoods, according to insurers. As a last choice, many have resorted to the state-mandated California FAIR Plan, a privately operated high-risk pool with limited coverage that can cost homeowners two to three times as much as a regular policy. There are now 449,800 FAIR Plan policies in the state, more than double from 204,800 five years ago.

Others are going to what are known as surplus line or non-admitted insurers, which can be costly and are regulated in states other than California. They are also exempt from the state’s rate control.

In any case, rates are typically higher, and even people who are offered conventional coverage are seeing significant price rises.

According to Dubrovsky, the majority of clients’ rates are increasing noticeably.

So why has home insurance in Brentwood and so many other parts of California suddenly become so costly and difficult to obtain? According to Dubrovsky, high-risk locations include suburban areas on the edges of the major cities in the Bay Area and areas with a lot of trees or timber that is prone to fire.

According to Dirk Ziegler, CFO of Zeigler Insurance in Brentwood, insurance firms are now closely examining underwriting rules, particularly in high-risk fire areas like Contra Costa County. Because of aged roofs, poor upkeep, and other fire hazards in older properties, Brentwood has had a large number of non-renewals.

Ziegler stated, “You have a lot of the older homes that were here many, many, many years ago.” We can now forecast future events, possible losses, and other things since we have a lot more data from all the wildfires and other events.

The updated fire hazard zone maps from the California Department of Forestry and Fire Protection for the parklands outside Brentwood indicate a larger risk than previously, according to Susanna Thompson, vice chair of the Contra Costa County Fire Commission. Parts of Summerset, including John Marsh State Park, and undeveloped areas next to the Trilogy and Vista Dorado neighborhoods have been elevated from moderate to high danger classifications, she added.

According to Thompson, the majority of this region is grassland rather than dense forest like in the highlands, yet in the summer, dried grass becomes particularly flammable, and grass fires can spread very quickly. A lot of my neighbors have had non-renewals, most likely as a result of recent modifications to the categorization of hazard zones.

According to Thompson, the higher risk rating is unfair because those fields are frequently utilized for hay cropping and cattle grazing, which helps to control the usage of flammable fuels. However, she also admits that the length of fire seasons has increased.

When Cal Fire issues new fire hazard maps for nearby metropolitan areas next year, things could grow worse, according to Chris Bachman, assistant chief and fire marshal at the Contra Costa County Fire Protection District. These will give maps that presently only display very high risk extra high and moderate ratings.

According to Bachman, this implies that more towns will probably be affected.

According to senior captain Brian Oftedal of the Oakland Fire Department, more fire stations could lessen the risk that residents face.

As part of the solution to some fire insurance-related problems, we’re preparing to start construction of at least one, if not two, fire stations in Brentwood soon, Oftedal added.

Villaseca and her neighbors are now using social media to share information on insurance premiums and insurers offering policies in their areas since homeowners like her haven’t felt like the state had their back.

“I have no idea what they’re doing,” Villaseca remarked. For this reason, we use Nextdoor.

Note: Every piece of content is rigorously reviewed by our team of experienced writers and editors to ensure its accuracy. Our writers use credible sources and adhere to strict fact-checking protocols to verify all claims and data before publication. If an error is identified, we promptly correct it and strive for transparency in all updates, feel free to reach out to us via email. We appreciate your trust and support!