A property that Marin County sold at a tax auction by mistake is being contested by a group of Tiburon homeowners.

The buyer, AssetRenew, a limited liability corporation, paid $6,600 for the package. The business now demands that the Tiburon View Homeowners Association either pay rent to utilize it or pay $1 million to get it back.

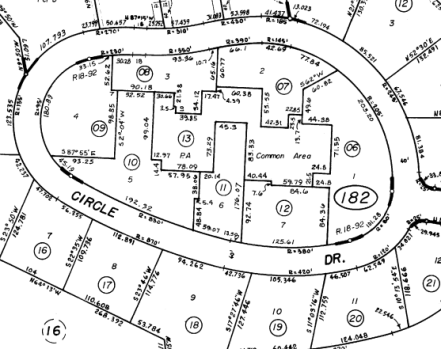

Seven association members who live on properties around the Circle Drive property can use the common space, which includes a pool, a recreation area, and laundry facilities. Because the association owing $625 in overdue taxes and $981 in penalties for the years 2013–2018, the county put it up for public auction in March.

Sandra Kacharos, the assistant director of finance for the county, stated, “We acknowledge that this was incorrect and that it must be revoked.” As the initial step in the legal process, we have requested that the buyer voluntarily retract. They have stated that is not their intention, though.

When someone called AssetRenew, they gave this response without providing any identification: I don’t have an answer. I am not permitted to discuss it.

“The principal Derek Leffers of Aptos, California, specializes in purchasing properties at tax sales to take advantage of situations like the one at hand,” said Richard Zuromski, the association’s attorney, in a letter to the county.

According to Zuromski, the buyer, acting through Mr. Leffers, has in fact requested payment of more than $1 million for the common area plot since it was purchased.

Zuromski claimed in his email that AssetRenew had held the association hostage over the common area parcel’s rent, despite the fact that the CC&Rs make it abundantly evident that the association and its members own the lots and have an easement over the common area parcel.

He claimed that if Leffers’ demands were not fulfilled, he would evict the association from the common area plot.

We believe that the Tiburon View Homeowners Association letter was deceptive and inaccurate in several parts, AssetRenew said in an unsigned letter to county supervisors.

According to the letter, the association may repurchase the property on the open market if they so desired, and AssetRenew had received several other offers for the property.

According to the letter, we are reaching out to the Board to clarify this procedure because we are having to incur considerable resources in dealing with it.

The sale was not brought on by past-due county property taxes.

Since the actual value of the common area is divided among the various lot owners, it has been given an assessed value of $1, according to Kacharos.

However, other taxation bodies allowed by ballot measures and other laws submitted direct charges because the common area was identified by its assessor parcel number, 034-182-13. The county tax collector may collect direct charges concurrently with other county property taxes on behalf of a taxing agency.

The tax collector received small direct charges from the San Francisco Bay Restoration Authority, the Marin Emergency Radio Authority, and the Belvedere Tiburon Library for the common area to pay.

Zuromski claims that the common area tax bill was first forwarded to Bayside Management and Leasing, the association’s manager, who paid it in addition to the tax payments for the other seven association members.

According to Zuromski, Bayside Management notified the USPS of its change of address when it relocated its office from Mill Valley to Sausalito in 2010.

He said that the tax bill for the common area parcel was not sent to Bayside’s new address for reasons the organization did not know.

According to Kacharos, a U.S. Postal Service notification does not alter an address for tax reasons under state law. A change of address must be reported to the county assessor by the owner of the record.

Relevant ArticlesReal estate | A San Jose housing tower with more than 300 units could support the downtown revitalizationBusinesses in San Jose are shocked by the closure of Capital Club, but it also presents opportunity.San Jose’s Capital Club closes, but a tech company occupies the high-rise space.Real estate | New restaurants, shops, and a movie theater are added to Mountain View CenterA tech and real estate company has agreed to a Menlo Park office, with adequate capacity for thousands of people.Zuromski also disputes whether the tax collector correctly identified the tax sale’s organization. According to state law, the tax collector must notify the parties of interest of the proposed sale by certified mail with a request for a return receipt to their last known mailing address, if available, and must make a good faith effort to find out their names and last known mailing addresses, he wrote in his letter.

He added that no notification of this tax sale was ever given to the management firm, the organization, or any of its members.

According to the county, the tax sale violated a state rule that forbids common areas from being the exclusive target of a property tax lien and denied the Tiburon View Homeowners Association due process. The county came to the conclusion that the sale was void and had to be canceled.

On November 5, county supervisors gave their approval for the revocation. However, Kacharos stated that collaboration from AssetRenew was a must for approval. The next step, she added, will be to take the matter to the Board of Supervisors for a hearing because AssetRenew has declined to support the sale rescission. There is currently no fixed time for that.

When a tax default is more than five years old, the county tax collector must put the property up for auction. Tax sales were held for 51 Marin properties between fiscal years 2017–18 and 2023–24.

According to Kacharos, her agency concentrates its efforts on houses with occupants and tries its best to assist owners in keeping their homes during tax sales. Seven homes were among the 109 lots up for sale in the tax sale that included the Tiburon common space. Ten of the empty lots were sold, and 89 of the parcels received no offers.

“All of the houses were saved,” Kacharos stated.

To avoid such mistakes, the tax collector is reviewing the way common spaces on the property tax lists are managed.

Note: Every piece of content is rigorously reviewed by our team of experienced writers and editors to ensure its accuracy. Our writers use credible sources and adhere to strict fact-checking protocols to verify all claims and data before publication. If an error is identified, we promptly correct it and strive for transparency in all updates, feel free to reach out to us via email. We appreciate your trust and support!